How to Use Predictive Targeting to Stay Ahead of Amazon's ads in 2026

13 min read

News

TL;DR

Amazon ads in 2026 are driven by short-term momentum, early intent signals, and performance velocity, not last month’s data or static keyword lists.

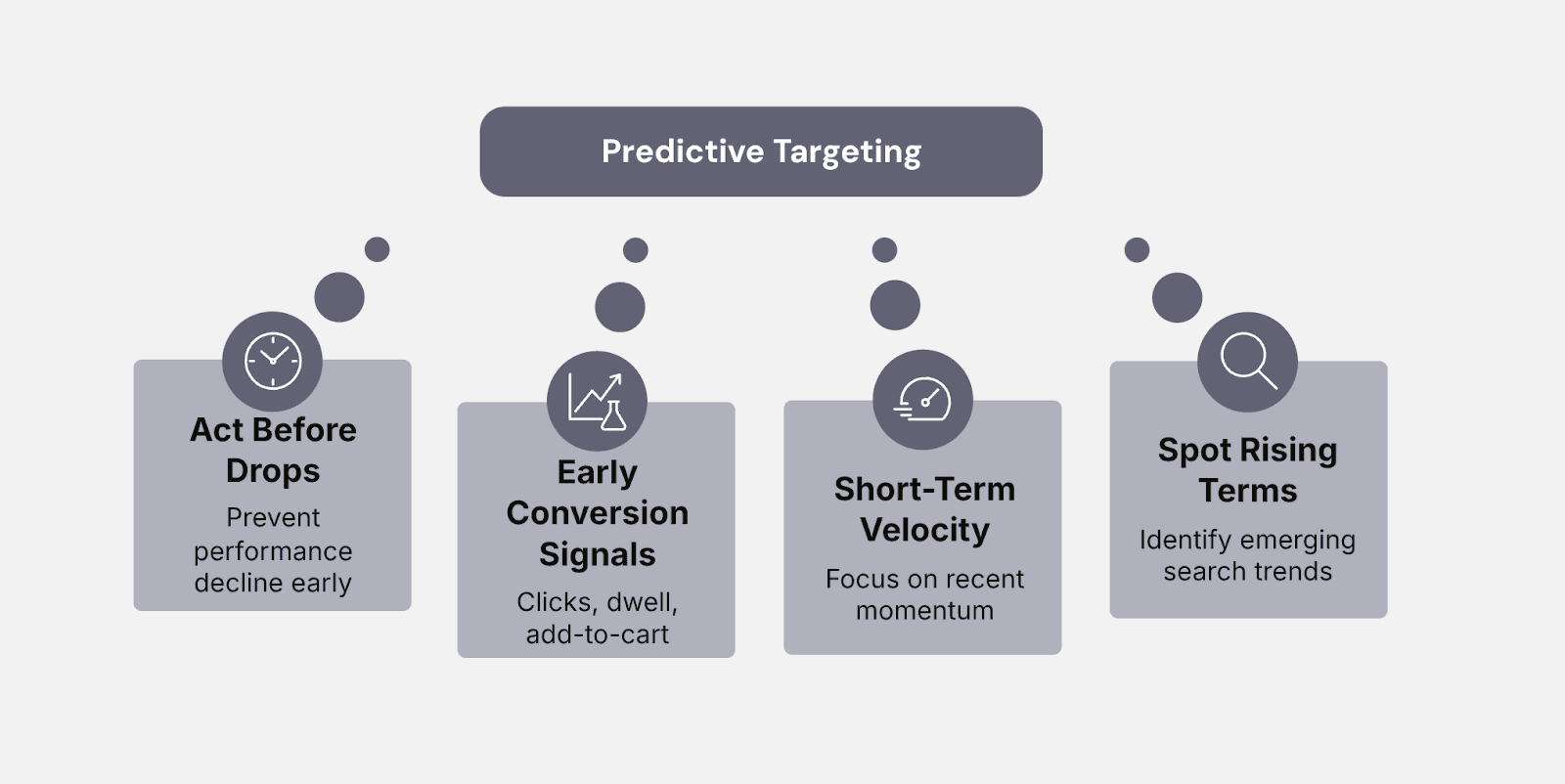

Predictive targeting focuses on early indicators like CTR shifts, dwell time, add-to-cart activity, and sales velocity to act before CPCs rise or performance drops.

Keyword discovery alone is no longer enough; success now comes from identifying intent and acting before competition and costs catch up.

Clean campaign structure and real-time bid and budget adjustments are critical for scaling without losing control or wasting spend.

Amazon evaluates ads using combined signals, CTR, CVR, and sales velocity, rewarding steady, efficient performance over reactive changes.

Sellers who move from manual PPC management to predictive, data-driven execution gain lower wasted spend, stronger placements, and more sustainable growth in 2026.

Does it feel like Amazon ads get harder right when you think you’ve figured them out?

One quarter, your campaigns look stable; the next, your CPCs creep up, margins shrink, and performance slips without any obvious mistake. You tweak bids, refresh keywords, and react to reports, but it still feels like Amazon is always one step ahead. That is because the system has changed faster than most sellers realize.

Amazon ads in 2026 are no longer driven by static keywords or last month’s data. The algorithm now reacts to short-term momentum, early intent signals, and performance velocity. Manual bidding and fixed keyword lists simply cannot keep up with that pace.

This blog breaks down how predictive targeting actually works inside Amazon ads, why keyword discovery alone is no longer enough, and how smarter systems are replacing reactive PPC management. This shift is exactly why sellers are moving toward the best PPC software available today, the tool built to predict outcomes, not chase them after the fact.

What does “predictive targeting” actually mean in Amazon ads?

Predictive targeting in Amazon ads is about acting before performance drops or costs spike, not reacting after the fact. Instead of relying on what worked in the last 30 days, it focuses on signals that indicate what is about to convert.

Think early clicks, dwell time, add-to-cart behavior, and keyword-ASIN relationships that are gaining momentum, even if sales have not peaked yet. In 2026, Amazon’s ad system puts less weight on long historical averages and more on short-term performance velocity.

Data shows that campaigns optimized within the first 7 to 14 days tend to achieve lower CPCs over time because Amazon’s algorithm rewards early conversion confidence. Waiting for “enough data” often means paying more later.

This is why prediction now beats optimization. Optimization fixes what already happened. Prediction positions your ads where demand is forming. Sellers who spot rising search terms, shifting buyer intent, and early conversion signals first give Amazon what it wants faster. The result is better placements, lower wasted spend, and a clear edge in increasingly competitive auctions.

Why is keyword discovery alone no longer enough?

Finding keywords is easy. Winning with them is not. By the time a keyword shows up as a “top performer” in most reports, it is already crowded, expensive, and heavily optimized by everyone else. Sellers end up chasing yesterday’s winners, paying higher CPCs for traffic that converts worse than expected.

That is the core problem with late-stage keyword discovery. Volume spikes first, CPCs follow, and profitability disappears fast. In modern Sponsored Ads, quality traffic beats volume traffic every time. A lower-search-term keyword with strong buyer intent often outperforms a high-volume term that attracts browsers instead of buyers.

This is where predictive systems change the game. Instead of waiting for sales history to pile up, they look at early conversion signals, ASIN-level behavior, and shifting search intent before CPCs spike. That means acting while competition is still low.

This is exactly the approach behind BidBison. It focuses on discovering high-performing keywords based on real conversion trends, not guesswork or outdated volume charts. The result is smarter traffic, earlier entry, and campaigns that scale without burning budget just to stay visible.

From setup to scale: automating campaigns the right way

In 2026, campaign success is less about how many levers you pull and more about how clean your foundation is. Campaign structure now plays a bigger role than ever because Amazon’s ad system reads patterns, not just bids. Messy setups confuse the algorithm. Clean, logical structures help it learn faster and reward you with better placements.

Predictive targeting only works when execution is tight. If keywords, match types, and budgets are scattered, even the best signals get diluted. That is why scaling ads today starts with getting set up right from day one, not fixing chaos later.

This is where our PPC research tool, BidBison, fits naturally. Campaigns are launched with built-in structure and guardrails, so automation does not mean loss of control. Keywords are grouped logically, budgets are protected, and scaling happens within defined limits.

Instead of spending hours creating and managing campaigns manually, sellers can launch faster and stay consistent as they grow. The result is less busywork, fewer structural mistakes, and campaigns that scale smoothly without constant micromanagement.

Smart bidding in a real-time advertising environment

Amazon ads no longer run in a stable bidding world. Every auction is real-time, influenced by shopper intent, competitor behavior, time of day, and even recent conversion signals. Fixed bids struggle here because they assume yesterday’s conditions still apply today.

In volatile auctions, static bids either overspend when competition heats up or miss impressions when demand suddenly rises. Amazon’s system rewards advertisers who show consistency and efficiency. Campaigns that adapt quickly, control wasted spend, and convert reliably tend to earn better placements over time.

This is where budget control becomes a ranking factor, not just a safety net. When your spend stays efficient, Amazon is more confident pushing your ads into higher visibility slots. In this case, Bidbison, instead of set-and-forget bidding, adjusts bids and budgets dynamically based on live performance signals. High-performing keywords get the push they deserve, while weaker ones are kept in check.

The result is smarter bidding without constant manual tweaks, better control in fast-moving auctions, and ad performance that stays aligned with how Amazon actually runs ads in 2026.

The signals Amazon uses to evaluate ad performance

Amazon does not look at one metric in isolation. CTR, CVR, and sales velocity work together to tell the algorithm a story about buyer intent.

A high CTR means shoppers are interested.

A strong CVR means they trust what they see.

Sales velocity confirms momentum.

When all three line up, Amazon leans in and rewards visibility. The mistake many sellers make is reacting too fast to the wrong signal. Pausing a keyword with a strong CTR but low early sales can kill future winners.

Scaling spend on sales alone, without watching CVR, often leads to wasted budget. Knowing when to push, pause, or scale depends on reading these signals together, not chasing one number. Amazon prefers steady, efficient performance over sudden spikes followed by drops.

That is why avoiding wasted spend without cutting off growth is such a fine balance. This is where BidBison adds clarity. Instead of raw data overload, it highlights what is working and why. Sellers see clear performance insights that help them act with confidence, protect momentum, and scale only when the signals truly support it.

Predictive targeting vs manual PPC management

Dimension | Manual PPC management | Predictive targeting systems |

Reaction speed | Actions taken after reviewing 7–30 day reports | Adjustments made within hours based on live signals |

Data used | Historical CPC, CTR, and past sales | Early CTR shifts, CVR trends, and sales velocity changes |

Scalability | Effective up to a small catalog, breaks at 50+ ASINs | Built to manage hundreds or thousands of ASINs |

Decision load | Dozens of daily micro-decisions per campaign | Decisions centralized and automated |

Cost efficiency | CPCs rise as changes lag behind auctions | Lower wasted spend by acting before CPC spikes |

Consistency | Performance depends on human availability | Same logic applied 24/7 without gaps |

Risk control | Pauses often overcorrect and kill momentum | Guardrails protect spend while scaling winners |

Strategic control | High effort, low leverage | Humans define goals, automation executes |

Why this matters in 2026: Amazon’s ad auctions shift by the hour, not the week. Sellers who rely on delayed data end up paying more for the same traffic. Predictive systems reduce lag, protect efficiency, and free sellers to focus on strategy instead of constant bid firefighting.

Conclusion

Amazon ads in 2026 do not reward sellers who work harder; they reward sellers who move earlier. Chasing keywords, fixing bids after costs spike, or reacting to weekly reports is no longer enough. The edge now comes from predicting demand, reading signals early, and acting with precision.

That is where data-driven automation fits into a modern Amazon Ads stack. When execution is handled systematically, sellers stop fighting fires and start scaling with intent. Using an AI-powered Amazon PPC optimization software is not about giving up control; it is about using better inputs to make better decisions.

If your goal is sustainable growth, lower wasted spend, and clearer insights, now is the time to move from manual chasing to predictive execution.